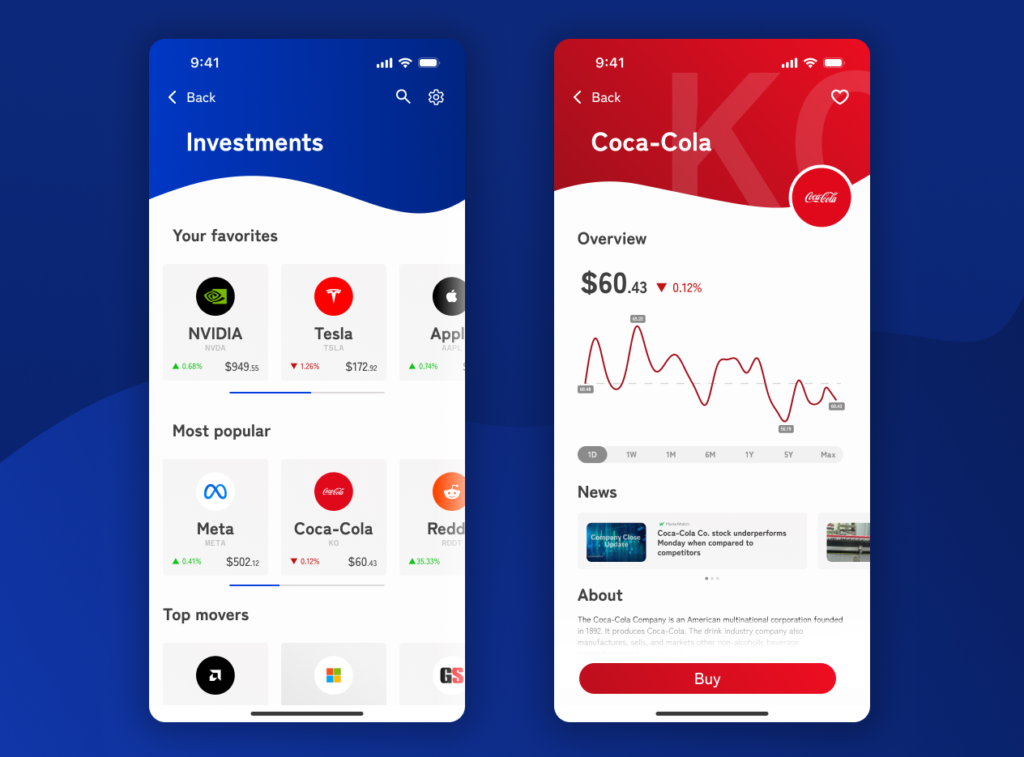

As tech and banking become more connected, it’s important to have advanced banking solutions. We collaborated with a top bank to improve how customers engage with the stock market on their mobile app. By letting people invest in stocks directly from their devices, we made it easier and more user-friendly for them to manage their money.

In addition to simplifying stock trading, investing through the mobile banking app offers the advantage of easy initiation. Existing bank clients can start without opening a new account or entering extensive details, reducing barriers and simplifying the initial steps towards investment.

This project is a big part of our work to update banking services, making it simpler for customers to invest and helping them take control of their finances.

Digitalizing The World Of Finance

Addressing the project’s challenge was straightforward. The bank required a platform for customers to engage with the stock market easily through an app. Our goal was to implement features that simplified the process of buying and selling stocks. We developed robust backend services and deployed them on a secure, scalable platform, ensuring reliability. Moreover, leveraging our expertise in crafting user-friendly mobile interfaces for both Android and iOS, we enabled customers to manage investments confidently. This delivered a modern investment solution, easily accessible at their fingertips.

Crafting the Future of Banking with .NET

Our development approach focused on using advanced, cutting-edge technology to improve the bank’s investment platform. We focused on creating strong backend services with .NET, guaranteeing smooth operation and security. We also deployed these services on an OpenShift Kubernetes cluster to provide unparalleled scalability and reliability. Additionally, our proficiency in native app development for Android and iOS enabled us to craft user-friendly interfaces. This greatly enhanced the overall experience for the bank’s customers.

Ensuring Error-Free Stock Orders

When dealing with real money, it’s important that everything operates flawlessly and is error-proof. We faced a tough problem: setting up stock trading orders. This complicated process involves changing currencies, taking money from the client’s account, and making orders through a vendor’s API. Each step required integration with a different system. We had to handle errors carefully to make sure the whole process worked as one unit. This prevented situations where money could be taken without successfully making an order.

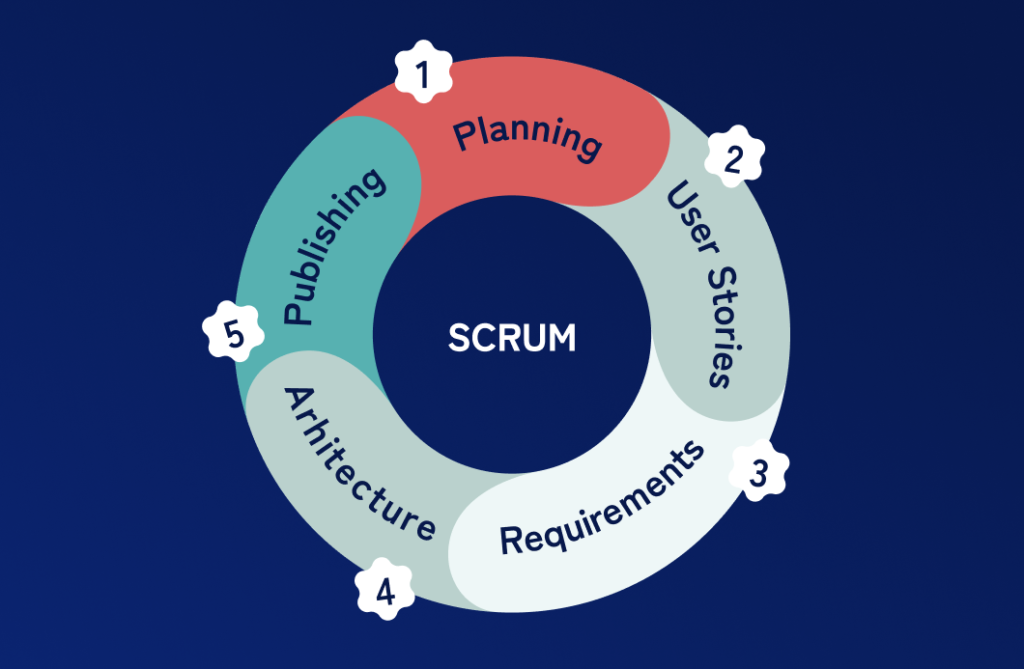

Agility In Action

Adding agility to the project was a key step made by our team. By using agile methods, we created a work process that was organized but could change easily, making room for constant feedback and fast changes. Using the scrum method made this process even better, allowing for quick updates and a great space for thinking up new features. This smart step did more than just improve the project’s development; it also played a big part in making the bank more digital and modern, which fits perfectly with our mission to innovate dynamically.

Advancing Financial Independence in Banking

We’re excited about how our project has redefined the banking experience! We’ve created an investment platform that is not just dynamic and user-friendly but also paves the way for a fresh, modern approach to banking services. We’ve equipped the banks’ customers with all the necessary tools for financial independence. This is a huge leap forward in empowering users to make smart investment decisions effortlessly.